Wave Accounting is a cloud-based accounting software designed for small business owners and freelancers. It was launched in 2010 in Toronto, Canada, and has since grown to become one of the most popular accounting software for small business owners.

What is a Wave Accounting?

Wave Accounting offers a wide range of features, including invoicing, accounting, and payroll processing. It is a free software, meaning that users can access most of its features at no cost. However, some features, such as payroll processing, may require users to pay a fee.

Wave Accounting has gained popularity among small business owners due to its user-friendly interface, automation features, and affordability. In this article, we will explore the features of Wave Accounting, its pricing plans, and how it can benefit small business owners.

How Does Wave Accounting Work?

Wave Accounting is a cloud-based accounting software that works by providing a range of tools to manage your business’s financial transactions. Here’s how it works:

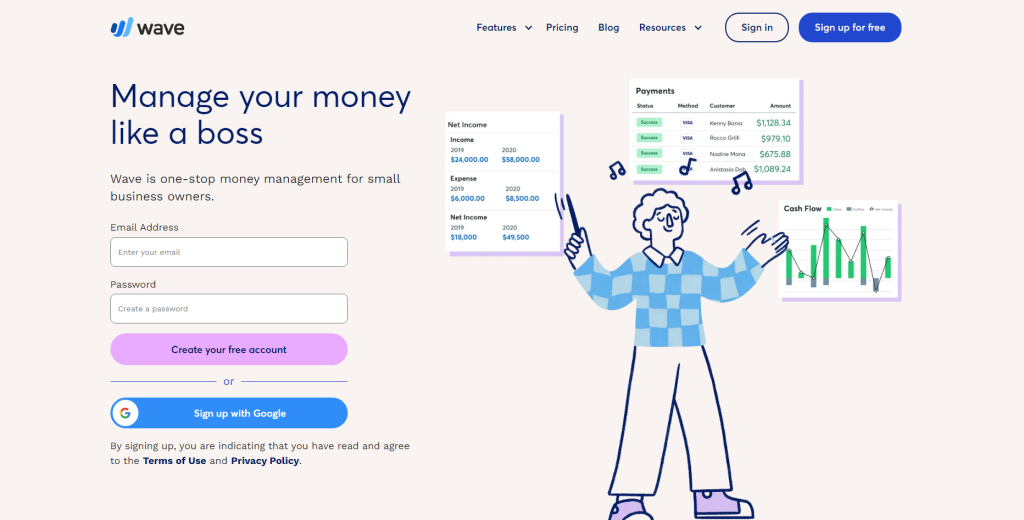

- Sign up: To get started with Wave Accounting, you need to create an account on the Wave Accounting website. You can sign up for free and start using the software right away.

- Set up: Once you’ve signed up, you’ll need to set up your account by adding your business information, such as your company name, logo, and contact details.

- Connect your bank accounts: Wave Accounting allows you to connect your bank accounts, credit cards, and other financial accounts to the software. This makes it easy to track income and expenses, and reconcile accounts.

- Invoicing: Wave Accounting allows you to create and send invoices to clients and customers. You can customize your invoices with your branding, and include payment options to make it easy for customers to pay.

- Receipt scanning: Wave Accounting allows you to scan and upload receipts using your mobile device, which can be automatically added to your accounting records.

- Accounting: Wave Accounting provides a range of accounting features, including tracking income and expenses, generating financial statements, and reconciling accounts.

- Payroll: Wave Accounting’s payroll feature allows you to pay employees and contractors, track employee hours, and manage tax filings.

- Payment processing: Wave Accounting allows you to accept payments from clients and customers using credit cards or bank transfers.

- Reporting: Wave Accounting provides a range of reports, including profit and loss statements, balance sheets, and cash flow statements, to help you analyze your business’s financial performance.

Overall, Wave Accounting is a user-friendly accounting software that provides a range of features to help you manage your business’s finances. Its cloud-based system makes it easy to access your financial data from anywhere, and its free pricing and range of features make it a popular choice for small businesses and freelancers.

What Are The Key Features of Wave Accounting?

Wave Accounting is a cloud-based accounting software designed for small businesses and freelancers. It provides a range of features to manage financial transactions, including:

- Invoicing: Wave Accounting allows you to create and send professional-looking invoices to clients and customers. You can customize invoices with your branding, and include payment options to make it easy for customers to pay.

- Receipt scanning: Wave Accounting allows you to scan and upload receipts using your mobile device, which can be automatically added to your accounting records.

- Accounting: Wave Accounting provides a range of accounting features, including tracking income and expenses, generating financial statements, and reconciling accounts.

- Payroll: Wave Accounting’s payroll feature allows you to pay employees and contractors, track employee hours, and manage tax filings.

- Payment processing: Wave Accounting allows you to accept payments from clients and customers using credit cards or bank transfers.

- Bank reconciliation: Wave Accounting makes it easy to reconcile your bank accounts, credit cards, and other financial accounts.

- Reporting: Wave Accounting provides a range of reports, including profit and loss statements, balance sheets, and cash flow statements, to help you analyze your business’s financial performance.

- Multi-currency support: Wave Accounting allows you to invoice and track expenses in multiple currencies.

- Collaboration: Wave Accounting allows multiple users to access the same account, making it easy to collaborate with your team or accountant.

- Mobile app: Wave Accounting has a mobile app that allows you to manage your finances on the go.

Overall, Wave Accounting is a user-friendly accounting software that provides a range of features to help small businesses and freelancers manage their finances more efficiently and effectively. Its free pricing and range of features make it a popular choice for businesses looking for an affordable accounting solution.

Why Business Use Wave Accounting?

Businesses use Wave Accounting for several reasons, including:

- Free pricing: Wave Accounting offers a range of accounting features for free, making it an attractive option for small businesses and freelancers looking to save money on accounting software.

- User-friendly: Wave Accounting is designed to be user-friendly, with a simple and intuitive interface that makes it easy for users to navigate and manage their finances.

- Cloud-based: Wave Accounting is a cloud-based software, which means that users can access their financial data from anywhere with an internet connection. This makes it easy to manage finances on the go and collaborate with team members or an accountant remotely.

- Invoicing: Wave Accounting offers a range of invoicing features, including customizable templates, payment options, and automatic reminders, making it easy to create and send professional-looking invoices to clients and customers.

- Receipt scanning: Wave Accounting allows users to scan and upload receipts using their mobile device, which can be automatically added to their accounting records. This makes it easy to track expenses and stay organized.

- Accounting: Wave Accounting provides a range of accounting features, including tracking income and expenses, generating financial statements, and reconciling accounts. This makes it easy to manage finances and stay on top of the business’s financial health.

- Payroll: Wave Accounting’s payroll feature allows users to pay employees and contractors, track employee hours, and manage tax filings, making it easy to manage payroll and stay compliant with tax regulations.

Overall, Wave Accounting is a popular choice for businesses looking for a user-friendly, affordable accounting software that provides a range of features to manage their finances efficiently and effectively.

What Are The Different Versions of Wave Accounting?

Wave Accounting offers two versions: the free version and Wave Plus.

- Free Version: This version of Wave Accounting is completely free and offers a range of accounting features, including invoicing, receipt scanning, accounting, payroll, payment processing, bank reconciliation, reporting, multi-currency support, collaboration, and a mobile app. The free version is suitable for freelancers and small businesses looking to manage their finances more efficiently.

- Wave Plus: This is a paid version of Wave Accounting that offers additional features on top of the free version. Some of the additional features include advanced accounting, premium support, and bookkeeping review. Wave Plus is designed for larger businesses or businesses with more complex financial needs.

It is worth noting that while the free version of Wave Accounting offers a wide range of features, there are some limitations. For example, the free version only allows for a single user, and there are limits to the number of transactions that can be processed each month. Additionally, some features, such as payroll tax filings, are only available in certain countries. Businesses that require more advanced features or have higher transaction volumes may want to consider upgrading to Wave Plus.

How To Uses Wave Accounting?

Here are the steps to use Wave Accounting:

- Sign up: Visit the Wave Accounting website and sign up for a free account. You will need to provide some basic information about your business, such as its name, industry, and location.

- Set up your account: Once you have signed up, you can begin setting up your account by adding your business information, connecting your bank accounts, and customizing your invoicing templates.

- Record transactions: To record transactions, you can either manually enter them or upload bank statements. You can track income and expenses, create invoices, and manage expenses and bills.

- Reconcile accounts: To ensure that your accounts are accurate, you will need to reconcile your accounts regularly. This involves comparing your records to your bank statements to identify any discrepancies.

- Run reports: Wave Accounting provides a range of reports that can help you analyze your business’s financial performance. You can generate reports such as profit and loss statements, balance sheets, and cash flow statements.

- Use payroll: If you have employees or contractors, you can use Wave Accounting’s payroll feature to manage payroll and tax filings.

- Collaborate: Wave Accounting allows multiple users to access the same account, making it easy to collaborate with your team or accountant.

- Use mobile app: Wave Accounting has a mobile app that allows you to manage your finances on the go.

Overall, Wave Accounting is a user-friendly accounting software that provides a range of features to help small businesses and freelancers manage their finances more efficiently and effectively. With a little bit of setup, it is easy to use and can help you stay on top of your finances.

How Wave Accounting Can Benefit Your Business?

Wave Accounting can benefit your business in several ways, including:

- Cost-effective: Wave Accounting’s free pricing model makes it an affordable option for small businesses and freelancers who are looking for an accounting solution that won’t break the bank.

- User-friendly: Wave Accounting is designed to be user-friendly, with an intuitive interface that makes it easy for users to navigate and manage their finances. You don’t need to have a background in accounting to use Wave Accounting.

- Time-saving: Wave Accounting automates many accounting tasks, such as invoicing, payment processing, and receipt scanning, which can save you time and reduce the risk of errors.

- Accessible: Wave Accounting is cloud-based, meaning that you can access your financial data from anywhere with an internet connection. This makes it easy to manage your finances on the go or collaborate with team members or an accountant remotely.

- Invoicing: Wave Accounting offers a range of invoicing features, including customizable templates, payment options, and automatic reminders, making it easy to create and send professional-looking invoices to clients and customers.

- Receipt scanning: Wave Accounting allows you to scan and upload receipts using your mobile device, which can be automatically added to your accounting records. This makes it easy to track expenses and stay organized.

- Accounting: Wave Accounting provides a range of accounting features, including tracking income and expenses, generating financial statements, and reconciling accounts. This makes it easy to manage finances and stay on top of your business’s financial health.

- Payroll: Wave Accounting’s payroll feature allows you to pay employees and contractors, track employee hours, and manage tax filings, making it easy to manage payroll and stay compliant with tax regulations.

Overall, Wave Accounting is a popular choice for small businesses and freelancers looking for an easy-to-use, affordable accounting solution that provides a range of features to manage their finances efficiently and effectively.

What Are The Pros & Cons of Wave Accounting?

Here are some pros and cons of using Wave Accounting:

Pros:

- Free to use: Wave Accounting is free to use for businesses of all sizes, making it an affordable option for small businesses and freelancers who are looking for an accounting solution that won’t break the bank.

- User-friendly: Wave Accounting is designed to be user-friendly, with an intuitive interface that makes it easy to navigate and manage your finances. You don’t need to have a background in accounting to use Wave Accounting.

- Invoicing: Wave Accounting offers a range of invoicing features, including customizable templates, payment options, and automatic reminders, making it easy to create and send professional-looking invoices to clients and customers.

- Receipt scanning: Wave Accounting allows you to scan and upload receipts using your mobile device, which can be automatically added to your accounting records. This makes it easy to track expenses and stay organized.

- Integrations: Wave Accounting integrates with a range of third-party applications, such as PayPal, Stripe, and Shopify, which can help you streamline your accounting processes.

- Collaboration: Wave Accounting allows multiple users to access the same account, making it easy to collaborate with your team or accountant.

Cons:

- Limited features: Wave Accounting’s free plan comes with limited features, which may not be sufficient for larger businesses or those with complex accounting needs. Advanced features, such as payroll and advanced reporting, are only available through paid add-ons or by upgrading to the paid plan.

- Limited support: Wave Accounting’s customer support is limited to email, which may not be sufficient for businesses that require more immediate assistance.

- No phone support: Wave Accounting does not offer phone support, which can be frustrating for businesses that prefer to communicate over the phone.

- Security concerns: Some users have expressed concerns about the security of their financial data, as Wave Accounting is cloud-based and stores data on remote servers. However, Wave Accounting uses industry-standard security measures to protect user data.

- Limited customization: Wave Accounting’s templates and reports are customizable to a certain extent, but there are limitations to how much you can customize them. This may not be suitable for businesses that require a high level of customization in their accounting reports.

Read Also : What Is Sage & How To Uses?

Overall, Wave Accounting is a popular choice for small businesses and freelancers looking for an affordable, user-friendly accounting solution. While it has some limitations, its free pricing model and range of features make it a good option for businesses with basic accounting needs.

Conclusion

Wave Accounting is a popular accounting software that offers a range of features to manage finances efficiently and effectively. It is designed to be user-friendly and affordable, making it an ideal choice for small businesses and freelancers. Wave Accounting’s invoicing and receipt scanning features can help businesses stay organized, while its payroll and accounting features make it easy to manage finances and stay compliant with tax regulations. Although it has some limitations, such as limited support and customization options, its free pricing model and range of features make it a good option for businesses with basic accounting needs.